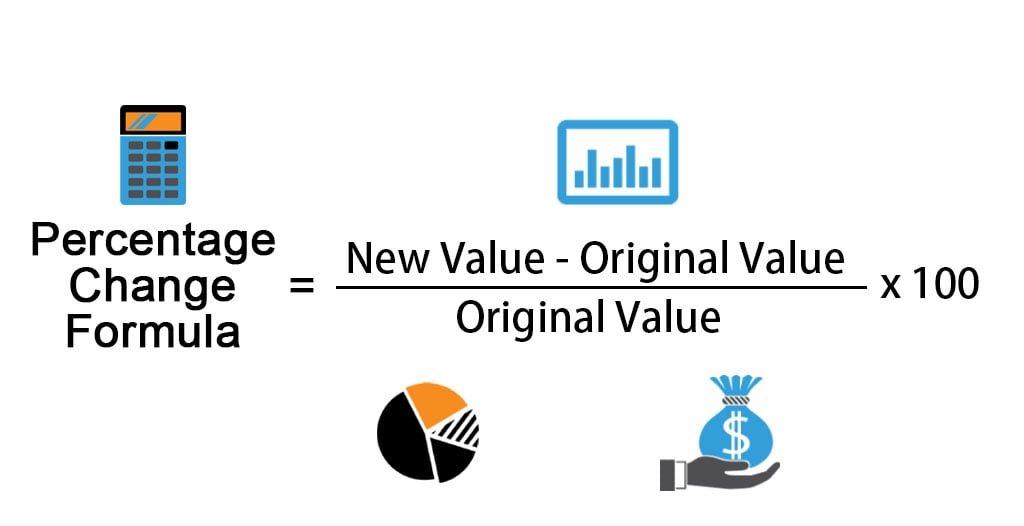

- Equilibrium Import Introduction Apr: N/Good

- Normal Apr: Ranging from per cent and % varying

Which card is perfect for House Depot loyalists, also those who are seeking generate otherwise increase their borrowing better value. Without annual commission otherwise lowest harmony standards, cardholders is also around skip loans Lordship it nonetheless enjoy advantages to build borrowing.

The house Depot credit is also an intelligent choice for investment huge do it yourself or recovery strategies toward home, deck or lawn. With that-seasons difficulty-100 % free returns, cardholders get an entire 365 months to return instructions for a complete refund, which supplies Diy-ers one another benefits and you may assurance.

Latest invited offer

Since the an incentive for brand new cardholders, our home Depot cards has the benefit of a little signal-right up incentive, but it is below what of numerous comparable cards bring. Just what this new cardholders get are a cost savings out-of $25 to help you $one hundred off their first purchase, with respect to the count invested. Which disregard would-be good news for a good strapped-for-dollars student, however, not such having a properly-dependent top-notch.

It credit also offers an introductory 0 percent Annual percentage rate having ranging from six and you will a couple of years to your sales of $299 or better ( % to help you per cent varying Annual percentage rate thereafter), based the credit rating. Again, which also provides certain relocate space having funding but can bring highest attention penalties for just one brief percentage error.

Benefits speed

They wouldn’t be strange to assume a giant brand name store including House Depot would offer charge card perks having investing in their priciest factors. Whatsoever, do it yourself programs can quickly seem sensible, with more individuals hanging out at your home, restorations tactics are on an upswing.

Unfortuitously, this is not the outcome to the Domestic Depot cards. It will not give any ongoing bonuses or perks system, and therefore of several cardholders will become using a different sort of advantages credit card of these large sales. When you’re hoping to secure items on buck, you’ll not get that here.

Most other cardholder advantages

Certain you are going to argue the greatest work for this card has the benefit of is the lower barrier so you’re able to entryway. Which have simple enough approvals and you will an excellent $0 annual percentage, it may be effortless-sailing for anyone having faster-than-high borrowing. There are also a couple most other number one advantages about cards to see.

Deferred desire

You to definitely sweet advantage of which cards ‘s the power to put-off appeal for as much as 6 months with the sales higher than $299. Having cardholders who want more time for you to pay back big commands, this will be an useful choice – but on condition that you really pay back the bill entirely and on date.

Even though it is a good cheer in order to delay paying rates of interest on big-citation activities, for those who underpay otherwise spend later, also by the a little, you’re going to get hit with high-notice percentage, added to the brand new get – which could be a cards destroyer eventually for specific.

Unique capital while in the promotions

Another advantage is the capacity to rating unique investment for right up so you’re able to couple of years – however, this might be applicable merely during the special advertising, that could otherwise might not let dependent on the project’s timeline. In such a case, deferred interest punishment and additionally pertain, so if you don’t pay the balance entirely at the end of this new promotion, you’ll be confronted with a premier-attract fee providing put in you buy.

Cost and you will costs

While it will not charges a yearly percentage or other type from restoration payment, new high focus costs you could potentially holder up to have later otherwise overlooked money is going to be high.

Leave a Reply